“Wealth is not about having a lot of money; it’s about having a lot of options.” – Chris Rock

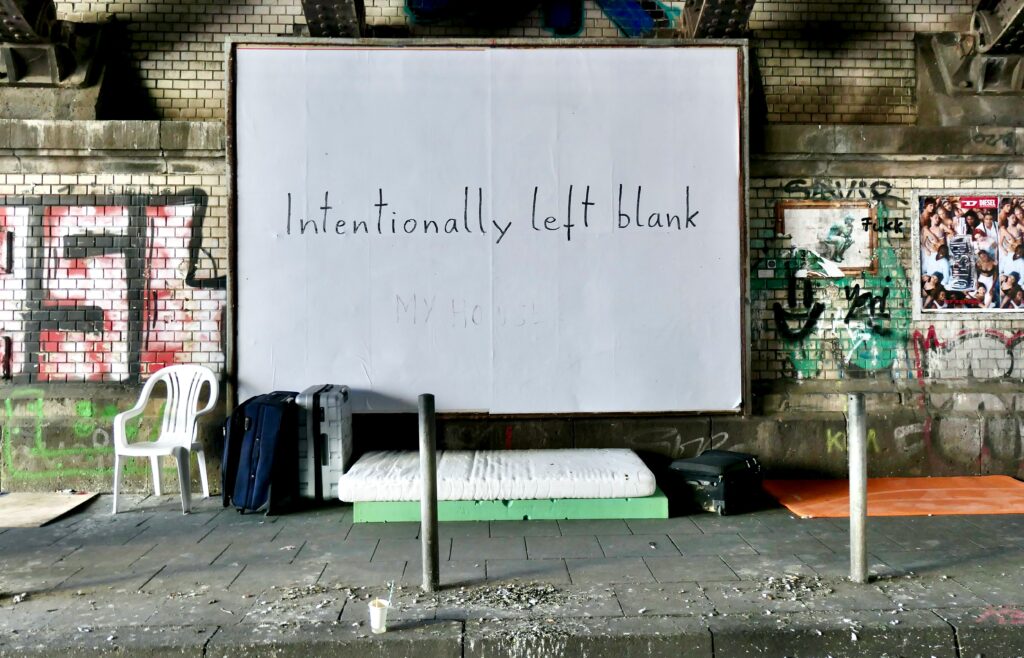

For many of us, building wealth can feel like a mystery—something reserved for the lucky, the elite, or the unusually disciplined. Or it can feel like a never ending journey that seems hard, rigorous, and always out of grasp. But here’s the truth: wealth building is a skill, not a secret. And like any skill, it’s powered by principles you can learn and apply.

At the heart of long-term financial success are three critical elements—what I call The 3 M’s of Wealth Building: Math, Momentum, and Mindset.

Let’s break each one down.

1. Math: The Foundation

Forget calculus. When it comes to wealth, the math you need is simple—but it’s non-negotiable.

- Do you know how much you earn vs. how much you spend?

- Are your assets growing faster than your liabilities?

- Is your money working for you through saving and investing?

Wealth is built on margins. The space between income and expenses is where freedom is born. It is simply income minus expensed to create excess margin to then invest, pay down debt, etc. The simple truth is that the math is just that — simple. You don’t have to have a degree in finance or even be a CPA to understand the foundational principle here. Sure, there are certain situations where other professionals help along the way but at its core, the math is just that — math and the last time I checked, 2+2 is still 4 (addition and subtraction) and 3 x 3 is still 9 (power of exponents).

Here’s the good news: The simple truth is that the math is just that — simple. You don’t need to be a financial analyst to master your money. You don’t have to have a degree in finance or even be a CPA to understand the foundational principle here.

Start by tracking your income, expenses, and net worth. Tools like a budgeting app or a simple spreadsheet can transform your awareness—and your outcomes.

🔹 Practical Step: Track your spending for the next 30-60 days. Awareness leads to control.

2. Momentum: The Power of Small, Consistent Action

“Success is the sum of small efforts, repeated day in and day out.” – Robert Collier

Most people overestimate what they can do in a day, and underestimate what they can do in a year. That’s where momentum comes in.

Wealth isn’t built in a sprint—it’s a long, steady walk. And every step counts.

- Automating a $100 monthly investment.

- Paying an extra $50 toward debt each paycheck.

- Reading one book a month on money, business, or mindset.

These small, repeated actions build unstoppable momentum. The key is consistency, not perfection. Momentum is defined by Webster as essentially “mass times velocity” (a simple explanation) and think of mass as your “army of dollars” (aka money) building over time to create more mass and moving forward through either debt reduction or savings/investing and the more you repeat it the faster the velocity and the greater the momentum. For example, if investing, there are plenty of charts out there that say saving or investing the first 100K is hard but then the next milestone gets easier (seemingly) because of the compound interest factor that begins to work for you even faster and faster…hence the momentum builds.

🔹 Practical Step: Choose one small wealth-building habit to automate—today.

3. Mindset: The Inner Game

“Your beliefs become your thoughts,

Your thoughts become your words,

Your words become your actions.” – Gandhi

This is where the real transformation happens.

You can have the math down and the systems in place, but if your mindset is rooted in fear, scarcity, or shame, your progress will stall. Wealth begins in the mind.

Common limiting beliefs:

- “I’m just not good with money.”

- “People like me don’t get rich.”

- “Money changes people for the worse.”

These beliefs create invisible ceilings. The good news? They’re learned—and anything learned can be unlearned.

Replace scarcity with abundance. Replace fear with curiosity. Replace shame with ownership. I think Mindset is the magnifying force of all three of these. Most people get discouraged or fail in their financial journey because of their mindset. Make no mistake, if you are in debt or just starting out on your journey, it can be hard. Mindset is as much about grit, determination and perseverance as anything and without the right mindset, the math will not matter, and the momentum will not be sustained.

🔹 Practical Step: Write down one limiting belief you hold about money. Then write a new one to replace it.

The 3 M’s Work Together

Think of it like this:

- Math is the map.

- Momentum is the movement.

- Mindset is the fuel.

If you focus on just one, you may see short-term gains. But when you align all three, you create sustainable, scalable, and soul-aligned wealth.

Final Thought

Wealth isn’t just about money. It’s about freedom, impact, and peace of mind.

So whether you’re just getting started or leveling up, ask yourself:

Am I nurturing all 3 M’s in my financial life?

Start where you are. Use what you have. Do what you can.

Wealth is waiting—and so is the best version of you.

“Do not despise small beginnings.” – Zechariah 4:10