Over my lifetime, I have run countless road races…everything from 5ks to a full marathon. I venture to guess I have now run close to a dozen or more half marathons. One thing I know about distance running is that it is a lot like building wealth…both take discipline, learning from others on how to train who have done it before, and perseverance, and resiliency. Building wealth is much like that…. a long process, disciplined behavior, consistency over time, and learning from others who have done it well. While there are many books and topics on wealth, I thought I would break down the 7 characteristics and habits of building wealth that when applied over a long period of time can have a significant impact and outcome. And just for fun, I cross-referenced these steps of building wealth to what it’s like to train for a long distance run as well. While the specific actions might be different, you may start to see that the mindset for both are somewhat similar, and self-discipline and determination are key traits as well.

Master the Fundamentals by Tracking and Managing Your Finances….(or in the world of running, you simply have to run to train and start logging miles)

While the mere mention of “budgeting” or “spending plan” and tracking expenses can send some people into a tizzy, it is vitally important. Let’s say I decided to blind fold you, drive you 250 miles away and drop you off and give you the keys and tell you to get back to the starting point. But you had no GPS and or no map. Sounds kind of ridiculous, doesn’t it? And yet, not budgeting and tracking your progress is like driving without knowing where you are going or from where you are starting. And reducing high interest, consumer debt is a part of this process to live on what you earn (actually to live on less than you earn) as part of the budgeting and monitoring performance.

Save and Invest Consistently…. (Run consistently and repeatedly according to a schedule)

This is where you live on less than you make and begin to save for life’s emergencies (the Emergency Fund for REAL emergencies – the unforeseen car repairs, broken appliances, etc.). And you begin investing money to gain compounding growth. The old saying that “time in the market beats timing the market” is true so start investing early. Create the healthy habit of investing for the LONG TERM. And begin taking advantage of tax-advantaged investing through employer retirement matching contributions, and other tax-deferred or tax-advantaged accounts like Healthcare Savings Accounts, 529 Plans (if you are saving for kid’s colleges), and more.

Increase Your Earning Potential …. (Train smarter using various training runs for various goals — speedwork vs. distance vs hill repeats for example)

Start investing in yourself with skill building for your job growth. Learn, acquire knowledge, build relationships and your network so that you can be the top choice for promotions or other growth-oriented jobs. Also, you can begin to explore side hustles for extra income or ways to build other skills. Warren Buffet is quoted as saying “the more you learn, the more you earn.”

Acquire Appreciating Assets…… (Technology can be an asset, like pace setting watches or heart monitors to help you perform better)

As you invest and save, make sure you are buying and spending the majority of your investment on appreciating assets. John D. Rockefeller’s wealth is sometimes attributed to his investment philosophy on investing in businesses, land, and other appreciating assets that would increase in value over time. So, while the latest new car or (fill in the blank) may look good that investment isn’t going to necessarily pay as well as another that has long term growth in value. So, whether you like investing in the stock market, or new businesses that have long term value or real estate, find something that will appreciate over time and invest in that.

Build a Health Network of Relationships (Social Capital) …… (Training with friends is much easier than training alone)

Whether in your professional life, community, church/faith, or other networks, building solid healthy relationships is key. Connections matter and can lead to other connections.

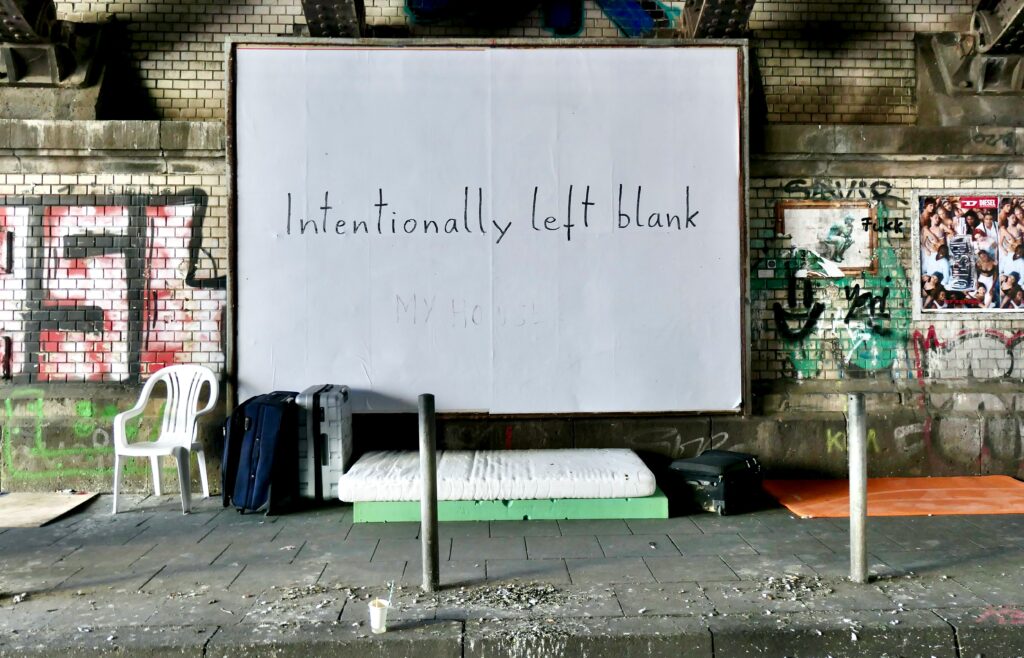

Maintain the Right Mindset ….(Think About Crossing the Finish Line and Why You Are Training to Stay Motivated)

To build wealth and success in just about anything you have to also have discipline, patience and resilience. So, while your money is growing, continue to live below your means and stay focused on the end game. Don’t get distracted by all the slick marketing and social expectations. Fight and resist the urge to have all the “latest stuff”. I am not suggesting you shouldn’t ever upgrade, etc. but be intentional and wise about how you spend money and any lifestyle expansion.

Protect Your Wealth …. (Prepare nutritionally and emotionally for race day!)

As your wealth grows and you accumulate more resources, inherently it will become important to consider how you minimize risk. Having experts can be helpful to help you structure your estate, plan for insurance needs, and minimize tax burdens to ensure your wealth is best utilized for your intentions, whether charitable giving/philanthropy, inheritance to loved ones, or personal consumption as you age or any combination thereof. In the world of personal finance, experts refer to building wealth as one of three stages most go through in life: Accumulation Phase, Preservation Phase, and Distribution Phase.